By Julie Verhage and Sonali Basak

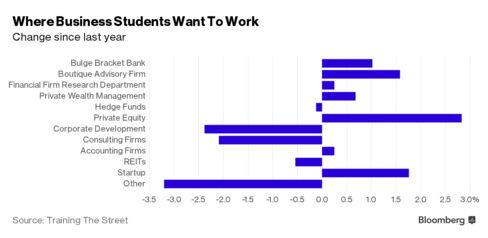

As business students pack up their belongings after graduation, fewer are listing hedge funds as a top destination, while private equity and startups are becoming more attractive.

According to a survey from Training the Street, a firm that offers technical training to Wall Street firms and business schools, startups and private equity firms saw a growing percentage of MBA students naming them as top destinations at which they wanted to work after graduation. At the same time, hedge fund, corporate development, and consulting firms all saw their appeal fall from the previous year. Apparently, the students weren’t deterred by the rise of robo-advisors either, as private wealth management saw gains from last year.

Here’s a broader look:

This could also be due to less recruiting by hedge funds. When asked what type of firms had been trying to recruit them, the number of respondents listing “hedge funds” dropped 3 percent from the previous year, while for private equity and startups, the numbers rose 4 percent and 6 percent, respectively.

For hedge funds, “you’re going to see a lot of MBAs select out of it because they say: ‘I need a job,'” said Scott Rostan, TSS’s founder. Students are thinking “I’m giving up two years of income, I’m going to business school, I may or may not have a family to support.” More than a quarter of respondents said a large bank was their top choice.

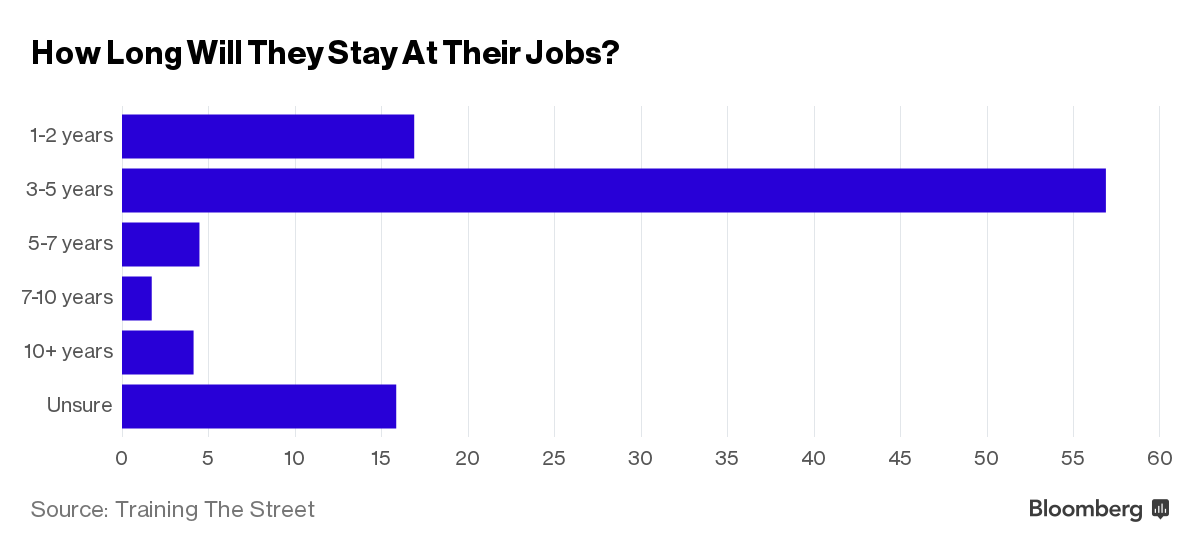

Wall Street typically sees high turnover from recent graduates, but the survey showed that they may stay a bit longer than expected. Still, they’re unlikely to make their first stop their last.

Wherever they end up, the students seem confident about their futures. More than 85 percent said they were at least somewhat optimistic about their job prospects after school. Given that most said they received more than one job offer and that the starting base salary was in six figures, it’s easy to see why.