What is a Long-term Investment (or “LTI”)?

There are different items that could be classified as a long-term investment. A parent company may have a small ownership stake in another company (i.e. there may be a strategic reason to have an ownership position in a key supplier). Note – this must be a minority stake in a subsidiary, typically less than 50%, which means the parent does not control the subsidiary and therefore does not consolidate the subsidiary’s results in its financial statements.

Additionally, a company will sometimes hold marketable securities or other fixed income investments. If these instruments mature in more than 12 months, they are classified as a LTI. For purposes of relative valuation (comparables) analysis, these items are usually treated as a cash equivalent since they can be liquidated quickly.

How do you know if a company has LTI?

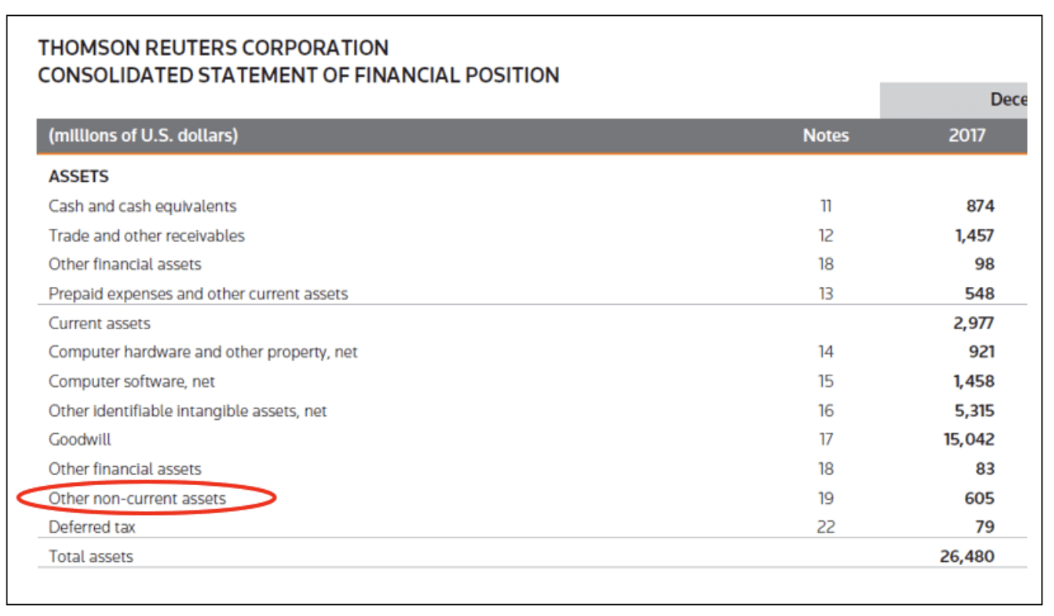

LTI can be found under the Long-term Assets section of the Balance Sheet. If the LTI is not significant, it may not appear as a separate line item on the Balance Sheet, but rather it will be included in Other Long-term Assets (see Figure 1 below). Readers may therefore have to review the notes to financial statements to determine if an LTI exists.

Figure 1:

How does the value of the LTI change over time?

The value of an LTI will change if it represents an ownership stake in another company and the disclosing company increases or decreases its ownership position through the acquisition / disposition of shares.

The answer to this question is also dependent on accounting standards. The method to account for a subsidiary will generally depend on the level of ownership in that subsidiary:

- Long-term Investments (Fair Value or Cost) (typically less than 20% ownership): In this situation, the fair value of the investment is reflected on the balance sheet. Any changes in fair value go through Comprehensive Income. In certain cases, investments are carried at cost (no impact on the financials until disposition).

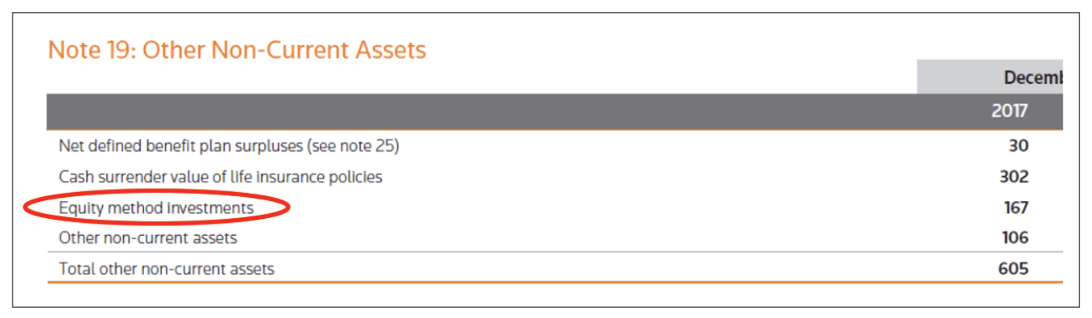

- Equity Method (Associates) (typically between 20% – 50% ownership): In this situation, the value of the investment reflects the proportionate share of the Associate’s Common Equity account (i.e. increases by the share of Net Income less any Dividends declared). The amount will be carried on the Balance Sheet under Long-term Assets and may be listed separately or be included as part of Other Long-term Assets (see Figure 2 below).

Figure 2:

Does LTI have an impact on the Income Statement or Cash Flow Statement?

The answer to this question depends on the accounting method used:

- Investments (Fair Value or Cost): Such an investment would generally have no ongoing impact on the Income Statement or Cash Flow Statement. However, if dividends are received on such investments, this amount would be shown on the recipient’s income statement as Investment Income which would appear below Operating Income. Therefore, it will then flow to the company’s Cash Flow Statement since it is included in Net Income.

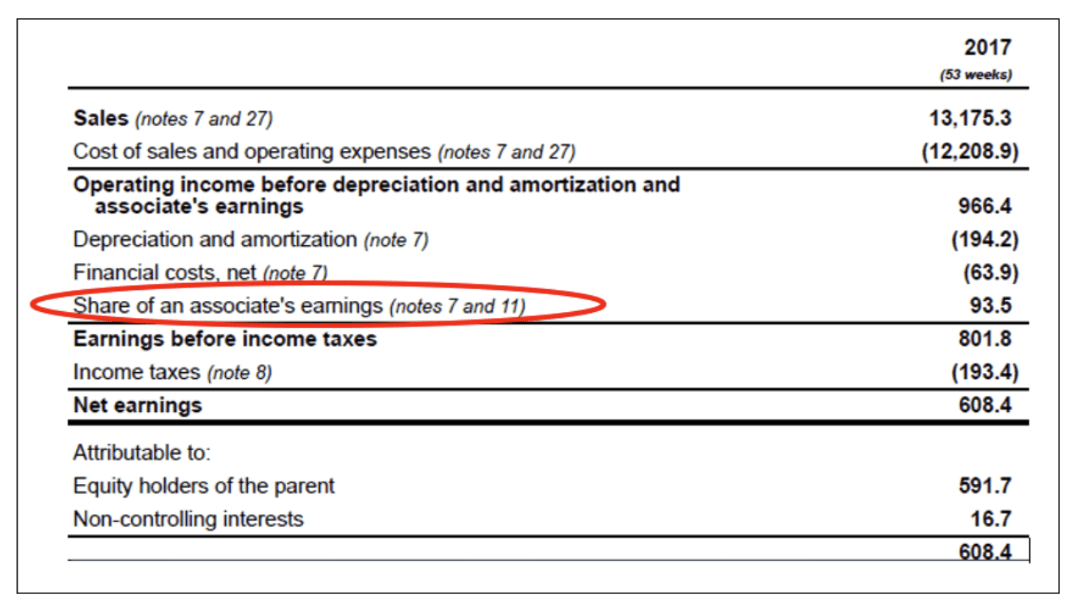

- Equity Method (Associates): In this situation, the equity holder will recognize its proportionate share of Net Income. This will appear as one line on the Income Statement (often called Share of Earnings from Equity Investees / Associates), typically below Operating Income. On the Cash Flow Statement, this income is subtracted from Cash Flow from Operations because it is non-cash. However, if any cash dividends were received from the Associate, these amounts are netted from the adjustment.

Figure 3 below shows the equity method of income from an LTI that would be reversed in the Cash Flow statement since it is a non-cash amount.

Figure 3:

If the company increases or decreases its ownership position in the investee, this will be reflected in the Investment Activities section of the Cash Flow Statement.

Do you adjust Enterprise Value for LTI?

The value of LTI should be subtracted from Enterprise Value when calculating a multiple such as EV / EBITDA.

When a multiple is calculated, it is essential that both the numerator and denominator present the same collection of assets so that the multiple can be applied or compared to another company.

Without any adjustment, the enterprise value of a company will include the value of LTI through the stock price. In other words, equity investors price the value of their investments when valuing the stock. For example, in the case of a 30% owned equity method investment, the equity market will recognize the value of this stake in the stock price.

However, since LTIs are non-consolidated for financial statement purposes, they will not generate any operating results (i.e. revenues or EBITDA). As a result, the enterprise value includes the value of the investment but the EBITDA does not include any EBITDA contribution from that investment.

This creates a mismatch between Enterprise Value and EBITDA. Assuming ownership of 30% of an investee company, this can be demonstrated as follows:

Enterprise Value 30% of Investee’s Value

EBITDA 0% of Investee’s EBITDA

The most common way to correct for this mismatch is to subtract the value of the 30% investment in the investee’s value from the numerator.

Ideally, the market value of the LTI should be subtracted since the market is trying to price in market value into the stock price. In practice, if market value is not readily available, an estimate is made or, where the amount is not material, the accounting carrying value is used.

By removing LTI from Enterprise Value, do you ignore the value of any LTI of a target company?

No. We remove LTI from enterprise value to calculate a valid multiple which reflects the consolidated (i.e. EBITDA-generating) activities of the company. We then apply the chosen multiple to the operating results, such as EBITDA, of a target company. This will then give us the value of the target’s consolidated activities, but then if the target has any LTIs, we need to ADD the value of their LTIs to estimate the target’s equity value since shareholders of the target own the value of the LTI as part of their equity investment.

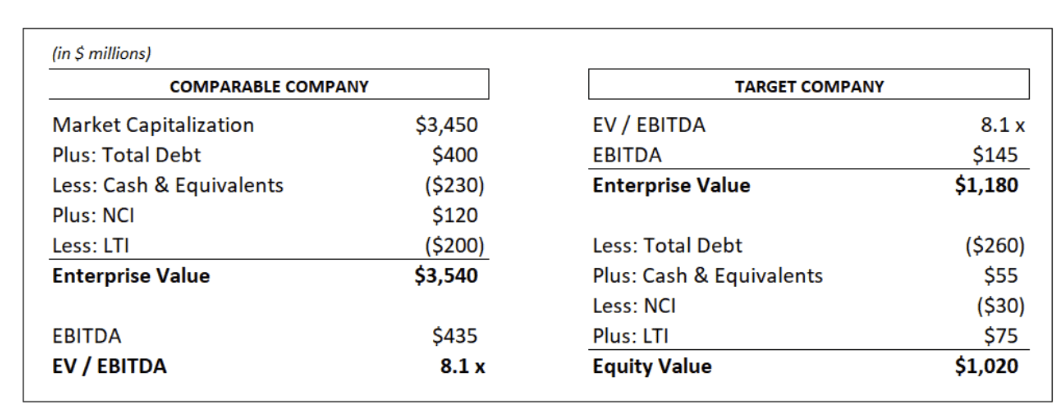

Figure 4 below shows a simple example of deriving EV using a comparable EV / EBITDA multiple, and the adjustments required for LTI and NCI:

Figure 4: