Buckle up because we’re diving into the thrilling world of private equity returns and exits. It’s been a wild ride, and trust me, you’ll want to hear all about it.

The Love Story with Private Equity Returns:

For the LPs, private equity has always been a love affair of sorts. Why, you ask? Well, it’s all about those steady, long-term returns and the magic word: diversification. In the turbulent seas of the financial world, private equity has been a reliable anchor.

2023: A Star Performance:

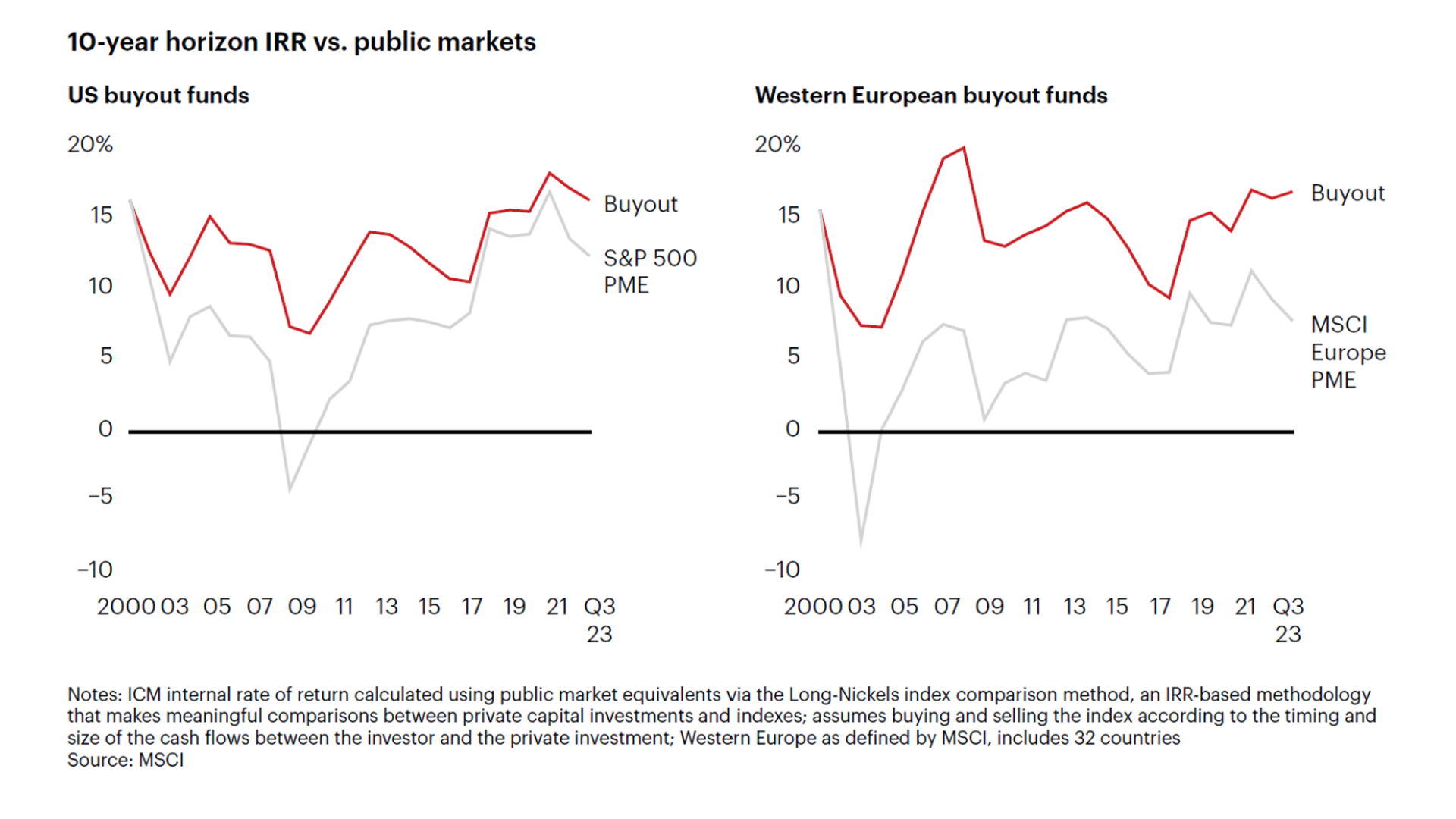

So, how did our star player perform in 2023? Drumroll, please! The 10-year horizon Internal Rate of Return (IRR) for buyout funds in the US and Western Europe showed a slight downward trend since 2021. But fear not, the industry still outshone public-market proxies and triumphed over the rollercoaster that is the public sector.

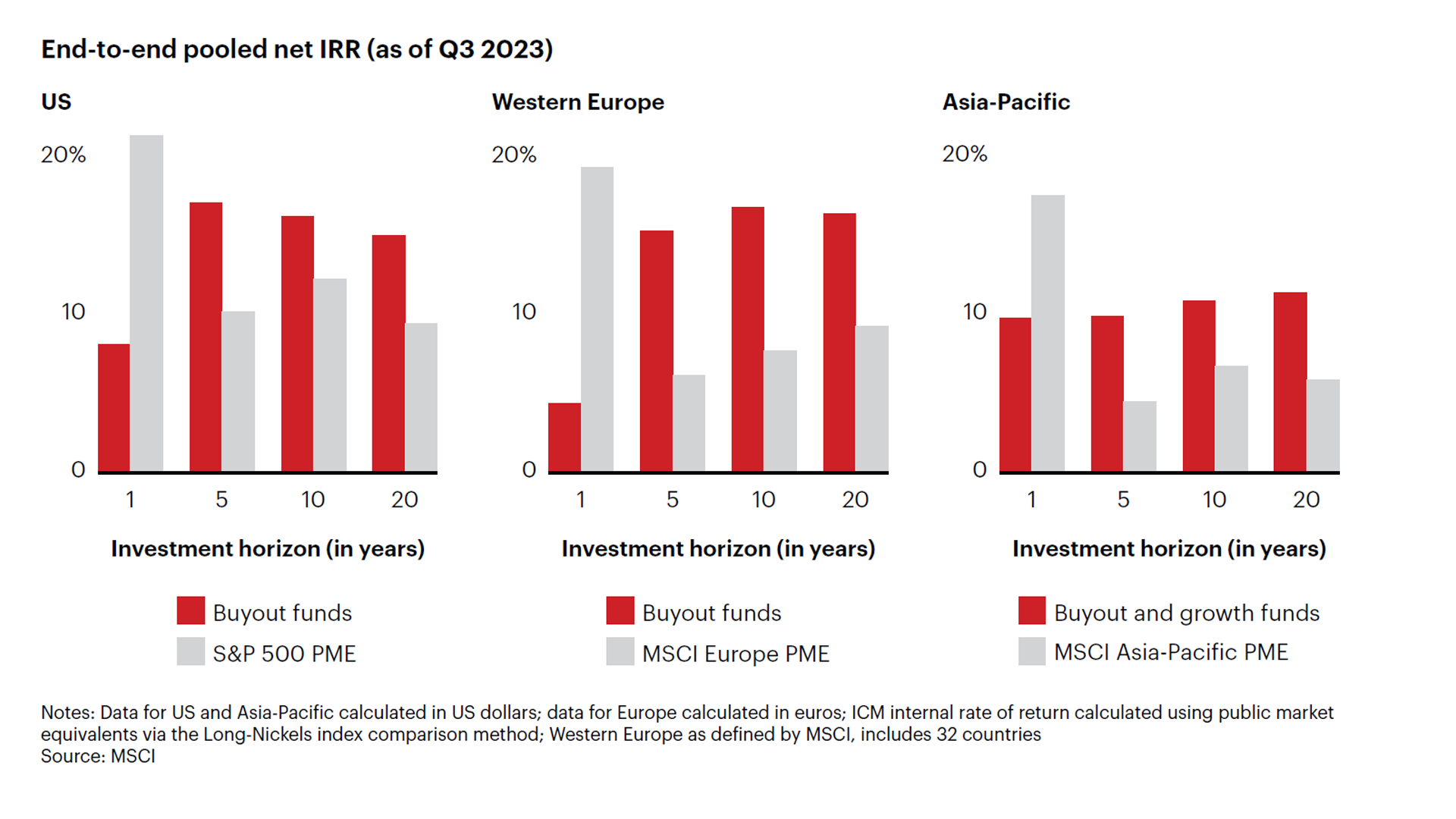

And this outperformance persists over time horizons longer than a year:

The Vanishing Act of Exits:

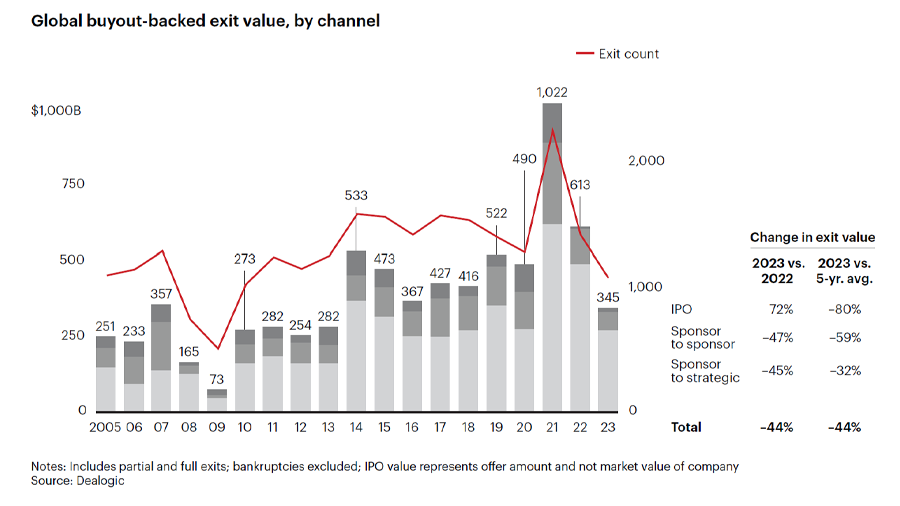

Returns are primarily made when you exit an investment – but global exits are hitting a 10-year low. Yep, you heard it right. Selling a portfolio company has become the Everest of challenges for private equity players. Rising interest rates and macro uncertainty threw a wrench into the works, resulting in a 44% decline in buyout-backed exits globally, hitting $345 billion. The total number of exit transactions fell by 24%, leaving everyone scratching their heads. The struggle is real:

Corporate Buyers and Strategic Tango:

Corporate buyers, the big players in the exit game, took a hit too. While they still accounted for 80% of total exit value in 2023, the value of these strategic deals plummeted by 45%. Harried executives tried to make sense of rising rates and the uncertain macro environment, leading to a bit of a corporate mergers and acquisitions pullback.

Sponsor-to-Sponsor Struggles:

Now, let’s talk private equity-to-private equity deals. The sponsor-to-sponsor channel faced similar challenges, with transactions dropping by a staggering 47% to $62 billion. Higher rates created a battleground where buyers and sellers faced different economics for the same asset, resulting in a gap impossible to bridge. (This article covers the woes of higher interest rates causing ripples in the private equity pond)

IPOs: A Glimmer of Hope?

In the midst of the chaos, IPOs tried to steal the show, rising to $11.8 billion from $6.9 billion in 2022. But, hold your horses – it only made up 3% of the total exit volume. Not exactly the cavalry riding in to save the day.

Buyout funds are staring at a mountain of $3.2 trillion in unexited assets.

Show Me the Value:

Sellers are now in the hot seat, juggling tough questions about the value they’ve added during the holding period. It’s like a game of chess – thinking hard and early about refreshing that value-creation plan. In a market turned topsy-turvy by stubbornly high interest rates, credibility is the name of the game.

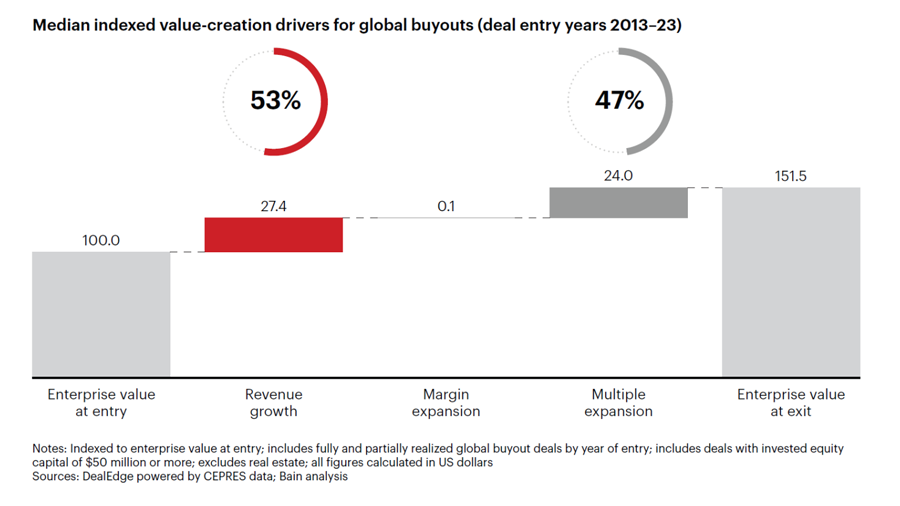

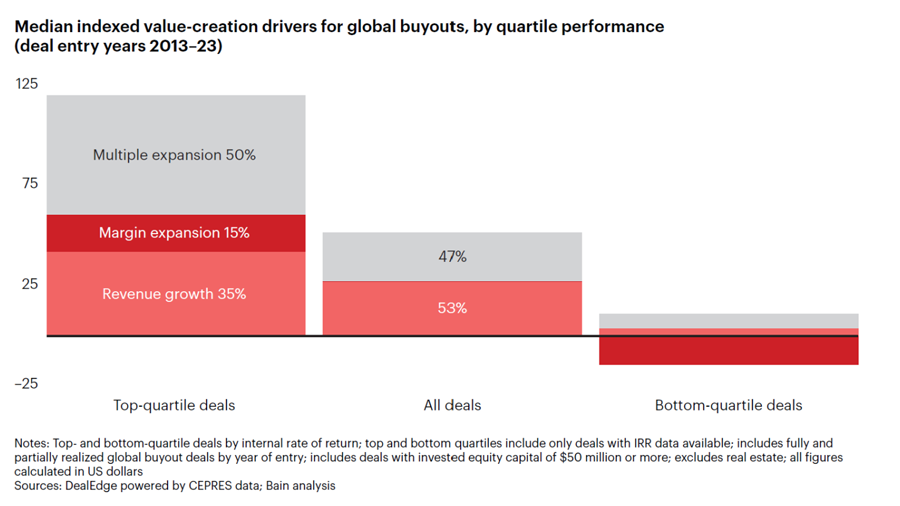

In the last decade, buyout funds have been riding the wave of revenue growth and multiple expansion,ignoring margin growth as a key value driver. Now, with the era of 0% rates in the rearview mirror, the game is changing. As interest rates play the high stakes game, maintaining stellar performance is calling on General Partners (GPs) to level up their strategies.

Top-Quartile Tactics:

Here’s where the plot thickens. The crème de la crème, the top-quartile deals, have a different playbook. While they too enjoy the benefits of multiple expansion, they’ve also been savoring the sweet taste of margin improvement. Operating leverage, my friends, is the secret sauce. It’s not just about boosting revenue but also cranking up those margins for a double whammy.

Buy Side Blues: Now, let’s talk about the buyers – they’re facing a straightforward problem. In the good old days, when multiple appreciation could carry almost 60% of buyout returns, risk-taking was the name of the game. But those days are gone with the wind of 0% interest rates. Now, higher financing costs and macro uncertainty mean the margin for error is slim. Buyers want rock-solid evidence that every dollar of projected earnings growth is not just a dream.

The Compulsory Checklist for Success:

For sellers, it’s a rude awakening. Selling in today’s market demands a lot more “show me the money” than they’re used to. In this chaotic market, closing deals requires a triple-threat strategy:

- Action-Driven Success: Show how management initiatives led to positive results during the holding period.

- Money Still on the Table: Lay out a clear path for future value creation.

- Reasons to Believe: Highlight how the company plans to accelerate revenue or improve profitability in the coming years.

These aren’t just nice-to-haves; they’re your survival kit in the exit jungle.

Proving Excellence:

The toughest challenge? Convincing everyone that your company’s stellar performance isn’t just riding the waves of economic and monetary tailwinds. You’ve got to show the world how operational excellence has fueled those improvements.

Survival of the Fittest in 2024:

As we venture into 2024 and beyond, figuring out how to make the returns dance without the tailwinds of macro conditions will be the real game-changer. The winners will be the ones who can pull out the magic tricks and create value through operating leverage, not just relying on past glories.

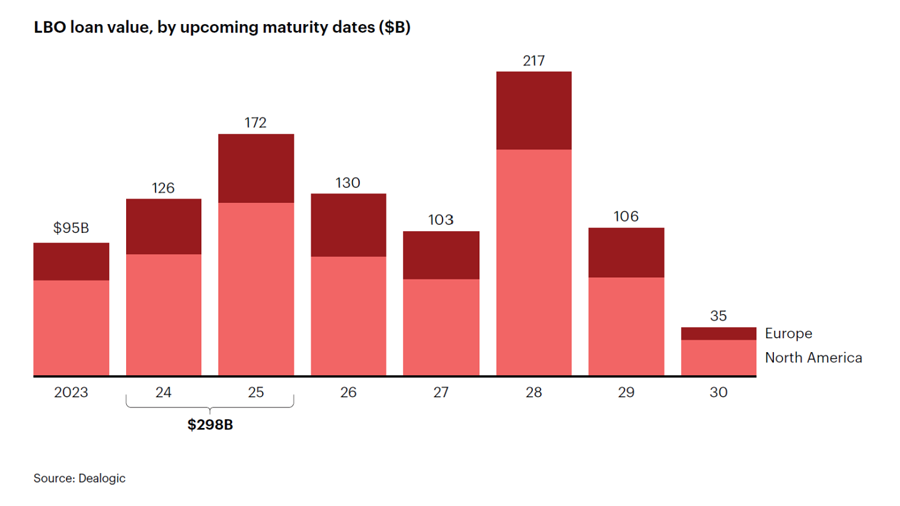

By year-end 2025, loans worth approximately $300 billion will mature, making life a rollercoaster for GPs who haven’t nailed their exit plans yet. It’s like planning a beach vacation, only to realize you booked during hurricane season. GPs are now playing financial Twister, trying to navigate maturing loans, rising rates, and a financial storm that’s making umbrellas obsolete.

So, there you have it – the story of Private Equity returns and the survival guide for exits in today’s topsy-turvy market.

This is the second in the series of a few bite-sized articles that I shall be adding here using the report published by Bain & company on Global Private Equity report 2024

Here’s the link to the first article.

This article was written by Rasna Saini, Financial Training Instructor at Training The Street.

Learn more with Training The Street

Training The Street offers Corporate Learning Solutions, Public Courses and Self-Study Courses to help you and your team unlock your career potential.