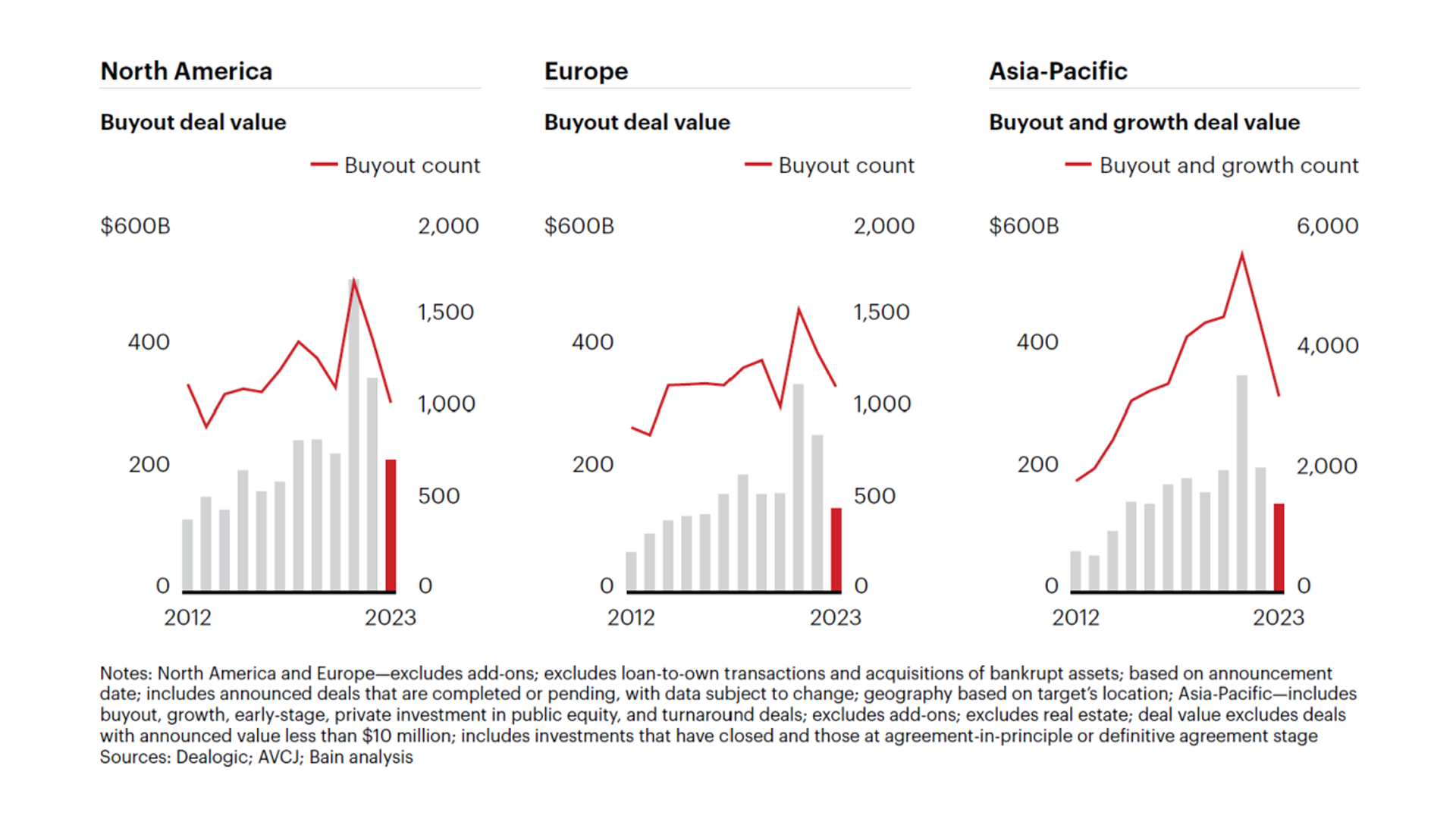

Hey there, finance enthusiasts! The private equity scene has been on a rollercoaster ride over the last couple of years, and trust me, it’s been no walk in the park for the big players. The reduced deal value and volume (title figure of this article) across the globe has the private equity world tossing and turning, and the culprit this time? Central bank rates. Buckle up as we dive into how the recent surge in rates has sent shockwaves through the private equity scene – the content in this article has been sourced from Bain & company’s Global PE report 2024 (you can find the link to the full report at the bottom of the article)

Unchartered territory

Picture this: the private equity industry going through a wild ride that’s not seen since the aftermath of the 2008–09 global financial crisis (GFC). But here’s the kicker – this time, it’s a whole new ball game. Deal values and counts have taken a nosedive (down 60%), exit values are down (66%) and capital raising is also not looking rosy compared to its peak time:

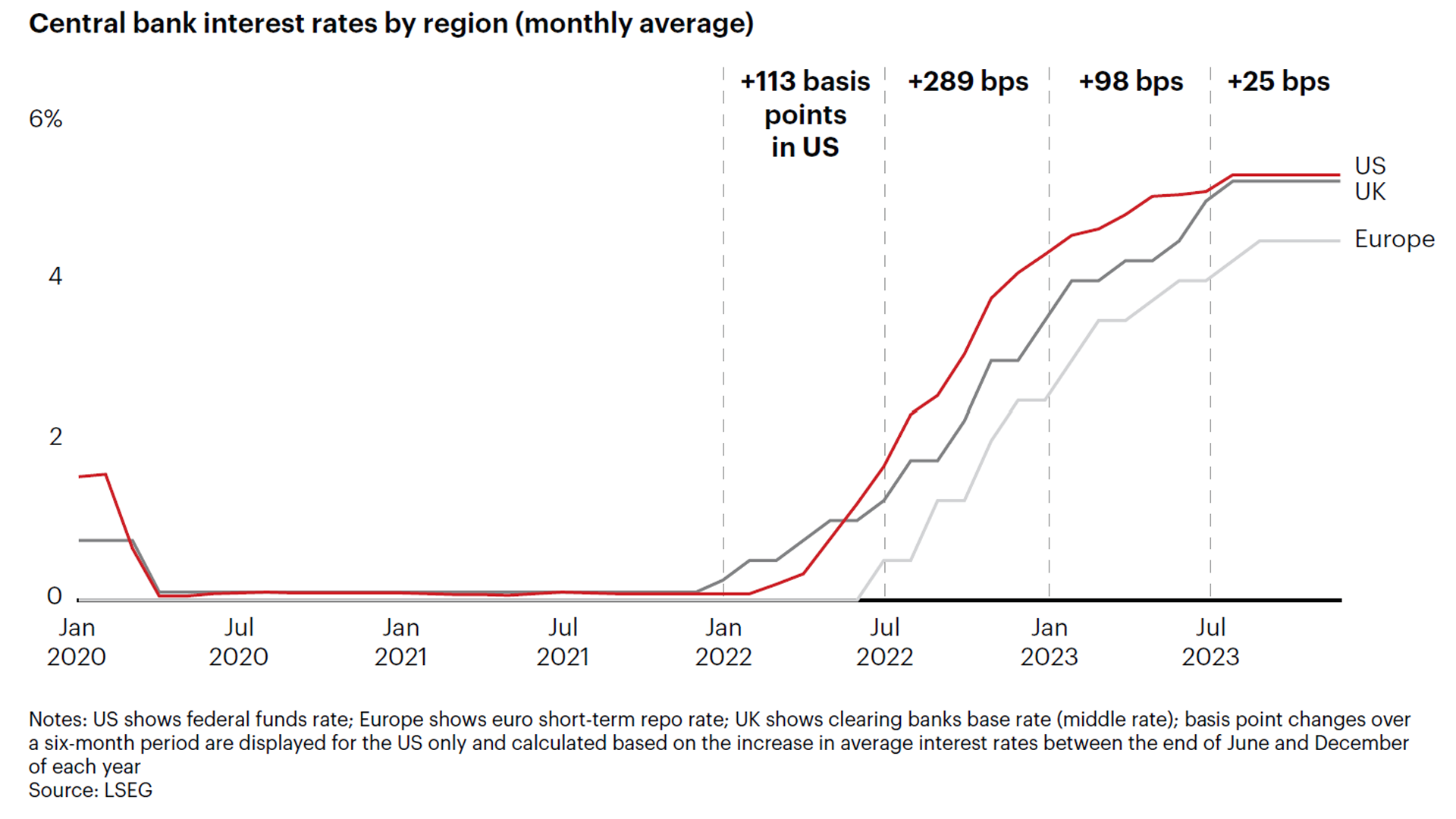

Now, you might think this sounds like déjà vu from the GFC but hold your horses! The reasons behind this rollercoaster are a whole different animal. Back in the GFC days, central bankers slashed interest rates to jumpstart the economy, and it worked. This time? Interest rates have shot up faster than a rocket, leaving everyone scratching their heads:

Confusing signals: Here’s where it gets interesting – the economy is doing surprisingly well! Record-low unemployment, decent growth, and the US public markets are on fire. But, and there’s always a ‘but’, concerns about the “most anticipated recession in history that hasn’t happened yet” are still hanging around like a stubborn guest.

These crossed signals have left private equity hamstrung. The sheer velocity of the interest rate shock was something few in the industry had ever experienced, and the impact on value has driven a wedge between buyers and sellers.

Buying and selling tango

The private equity players find themselves caught in a dance between buyers and sellers. Thanks to the swift interest rate shock, the value is taking a hit. Sellers are being choosy, only bringing their top-tier assets to the market. Exit doors are closing, leaving general partners with a whopping $3.2 trillion in unsold assets. Ouch!

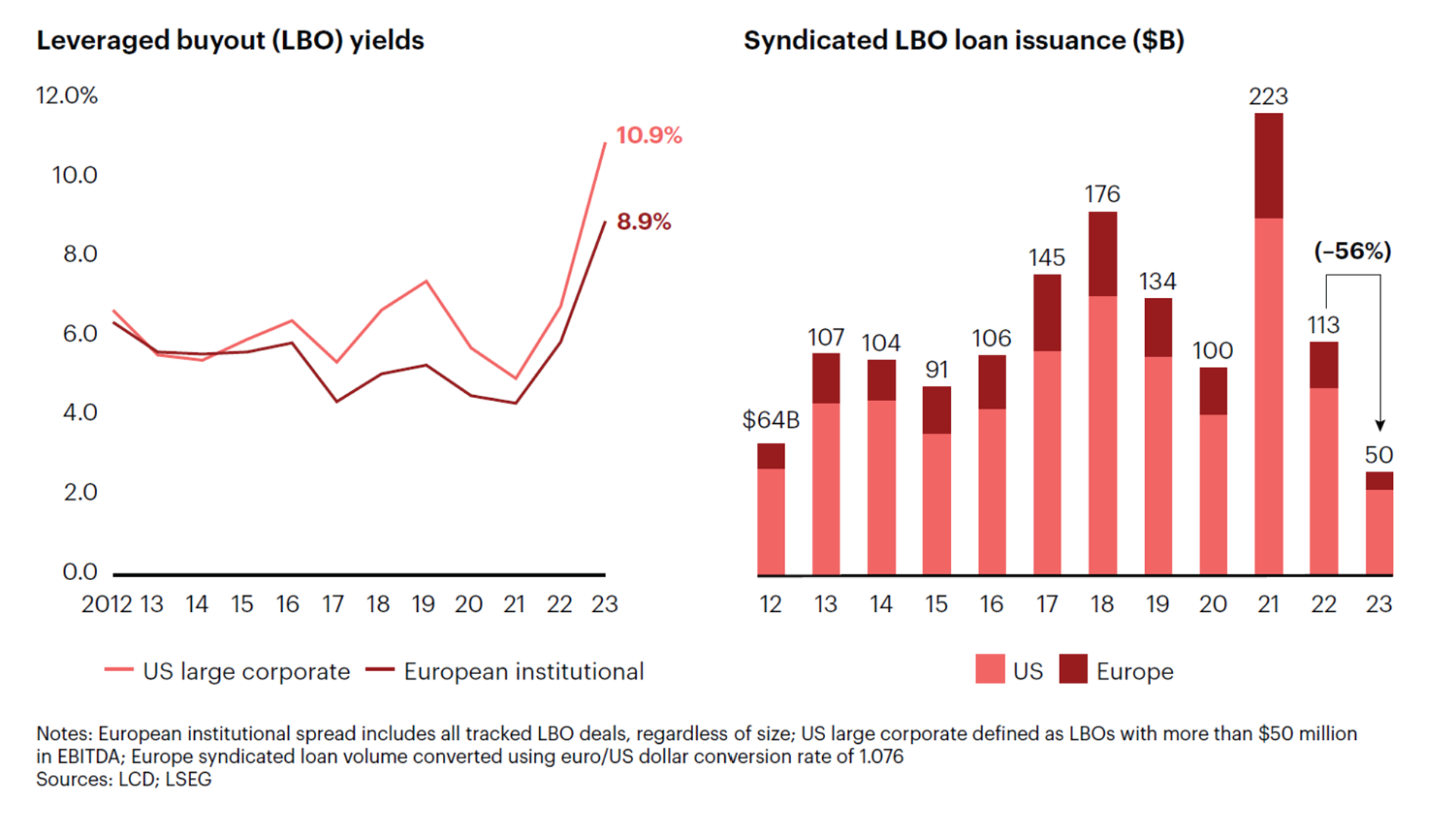

Deals of all shapes and sizes are feeling the heat, especially those dependent on bank financing. As yields on large, syndicated loans soared to 11% in the US and 9% in Europe (hello, 10-year highs!), banks started stepping back, and the issuance of new loans took a nosedive.

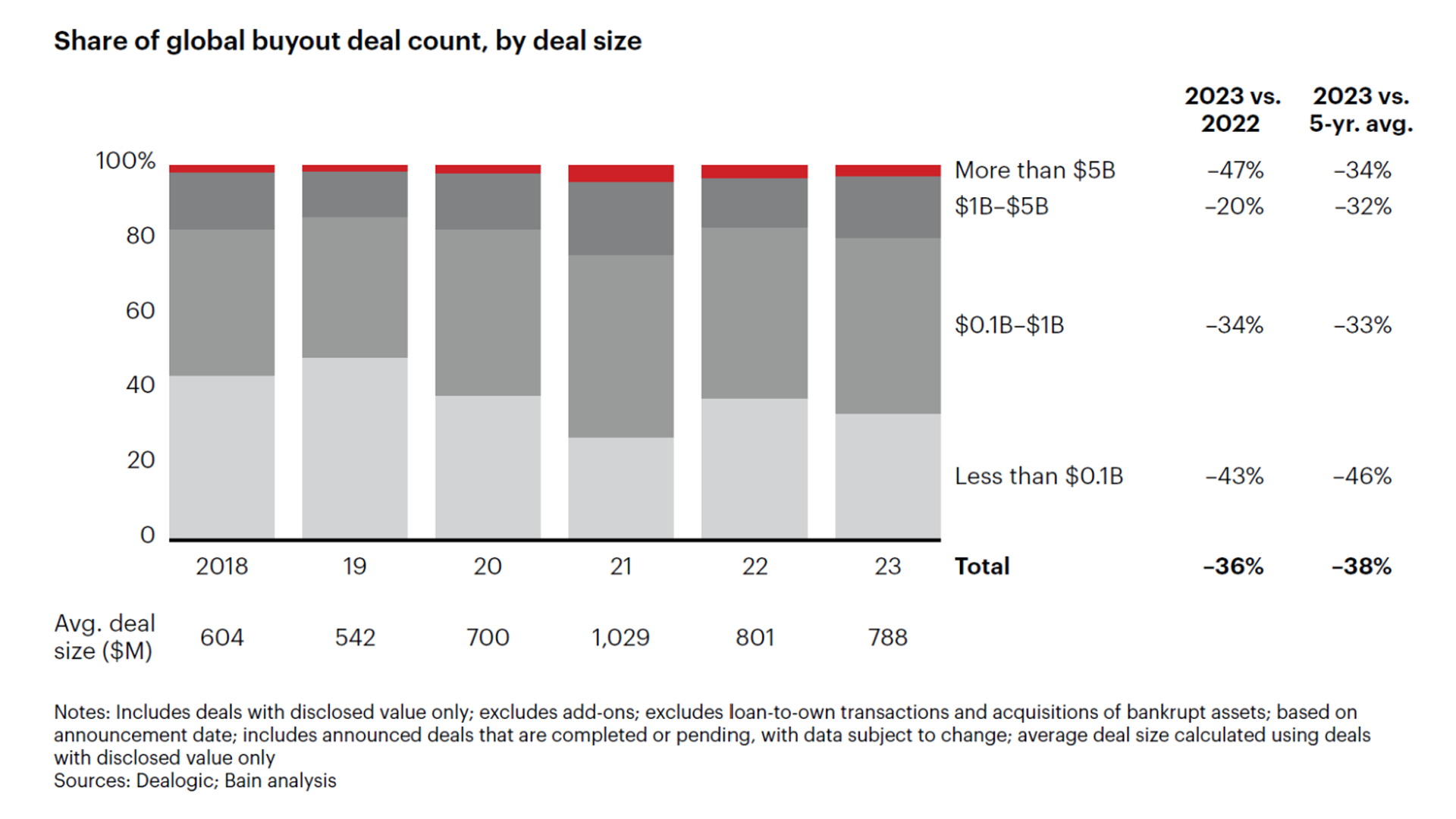

The result? The number of megadeals (those over $5 billion) almost halved, and the average deal size went from a peak of $1 billion in 2021 to $788 million in 2023.

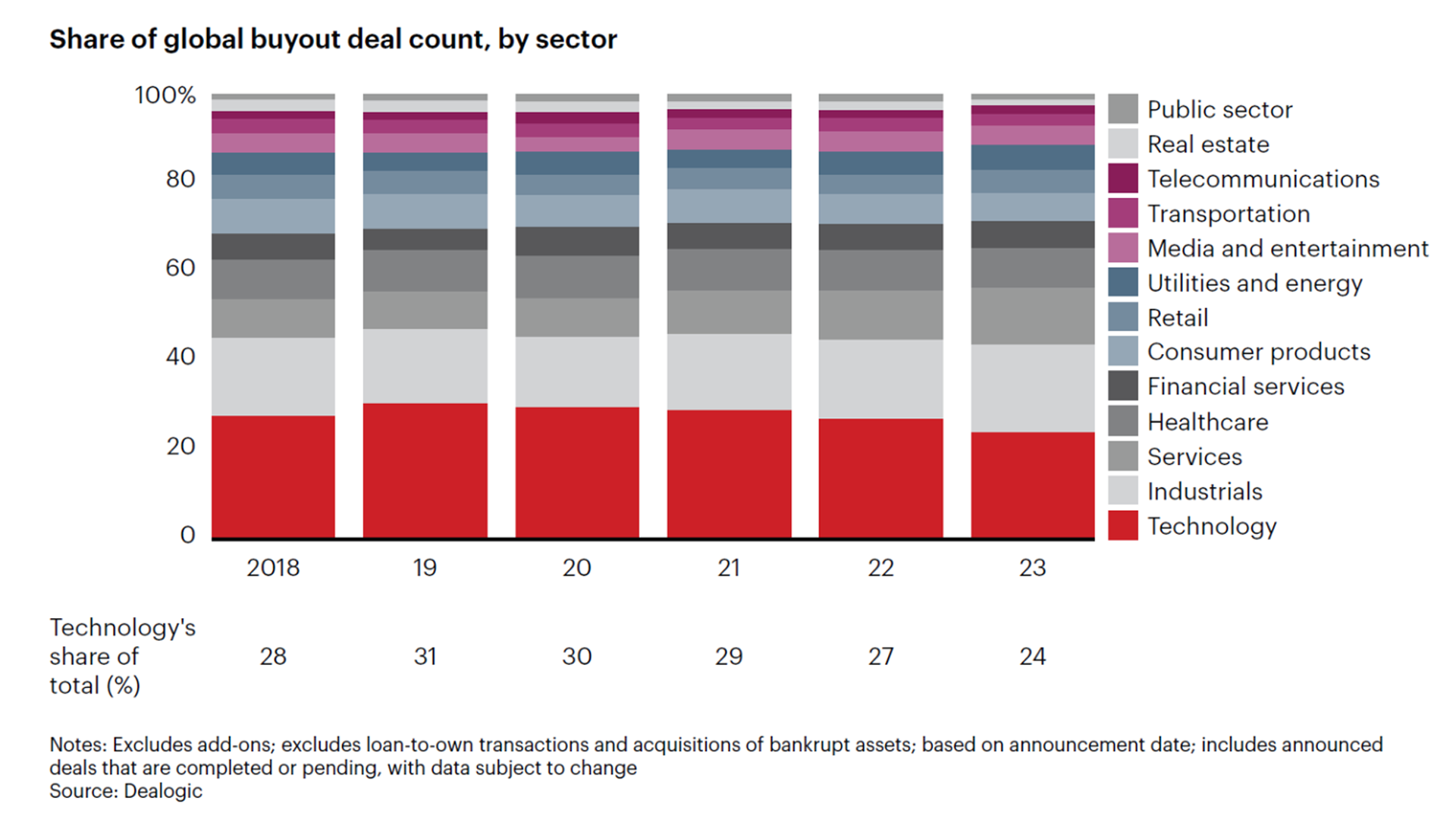

Buyouts Play the Shapeshifting Game: Buyouts faced the music with double-digit declines in deal count, but technology deals managed to hold their ground. Why? Well, tech deals naturally need less leverage, while good ol’ traditional industries like industrial goods and services saw a slight uptick. It seems investors were on a flight to safety, seeking stability wherever they could find it. Technology remained the leader in deal count, but industrials increased share as investors looked for stability in a traditional sector:

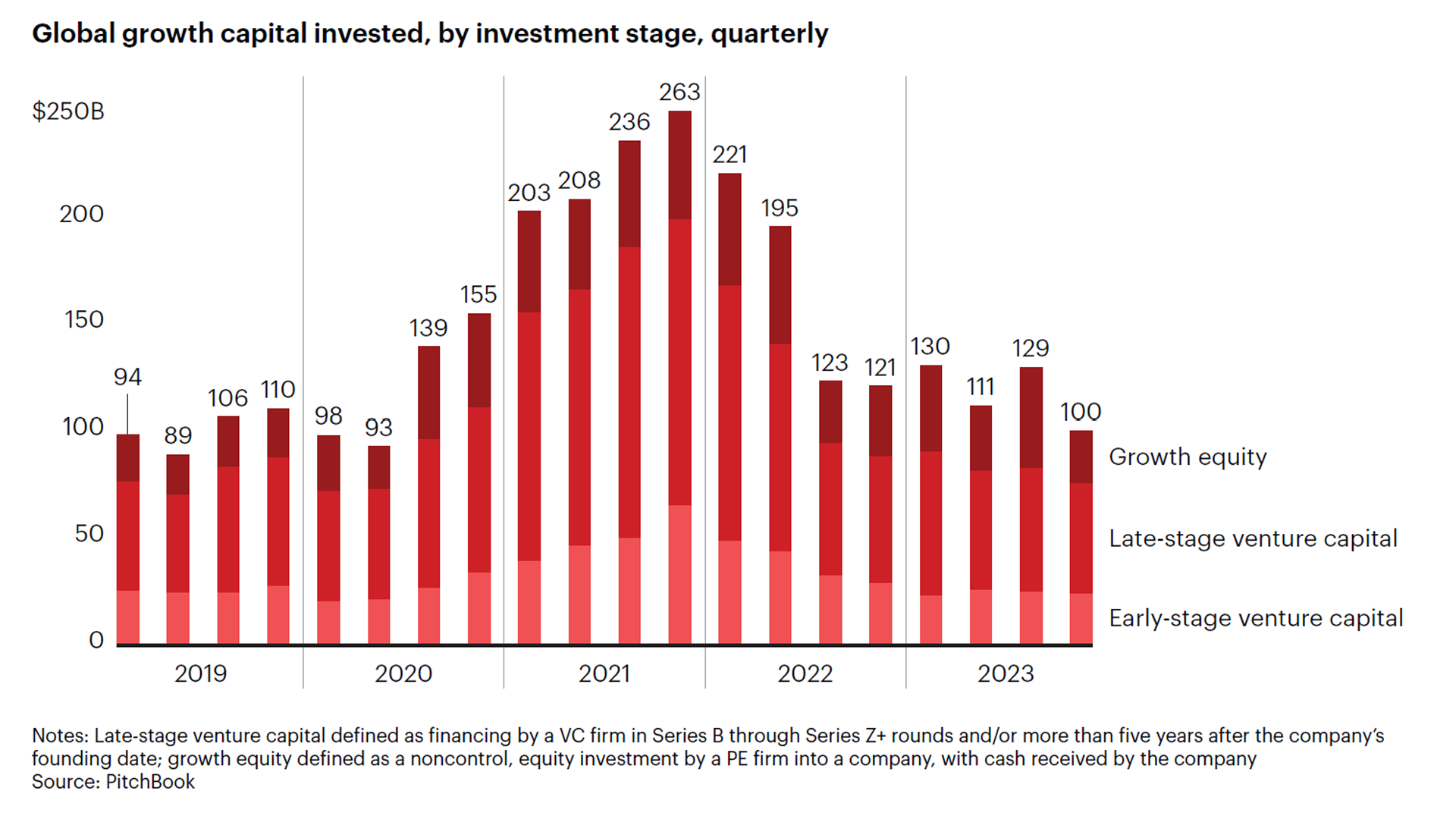

Growth and Venture Capital Ride the Sideways Wave: Meanwhile, growth and venture capital segments kept riding the sideways wave. Dealing with riskier, earlier-stage companies, they found themselves in the crosshairs of interest rate pressures. Throw in the remnants of the crypto collapse in 2022 and the Silicon Valley Bank implosion in 2023, and you’ve got a perfect storm.

Debt Metrics

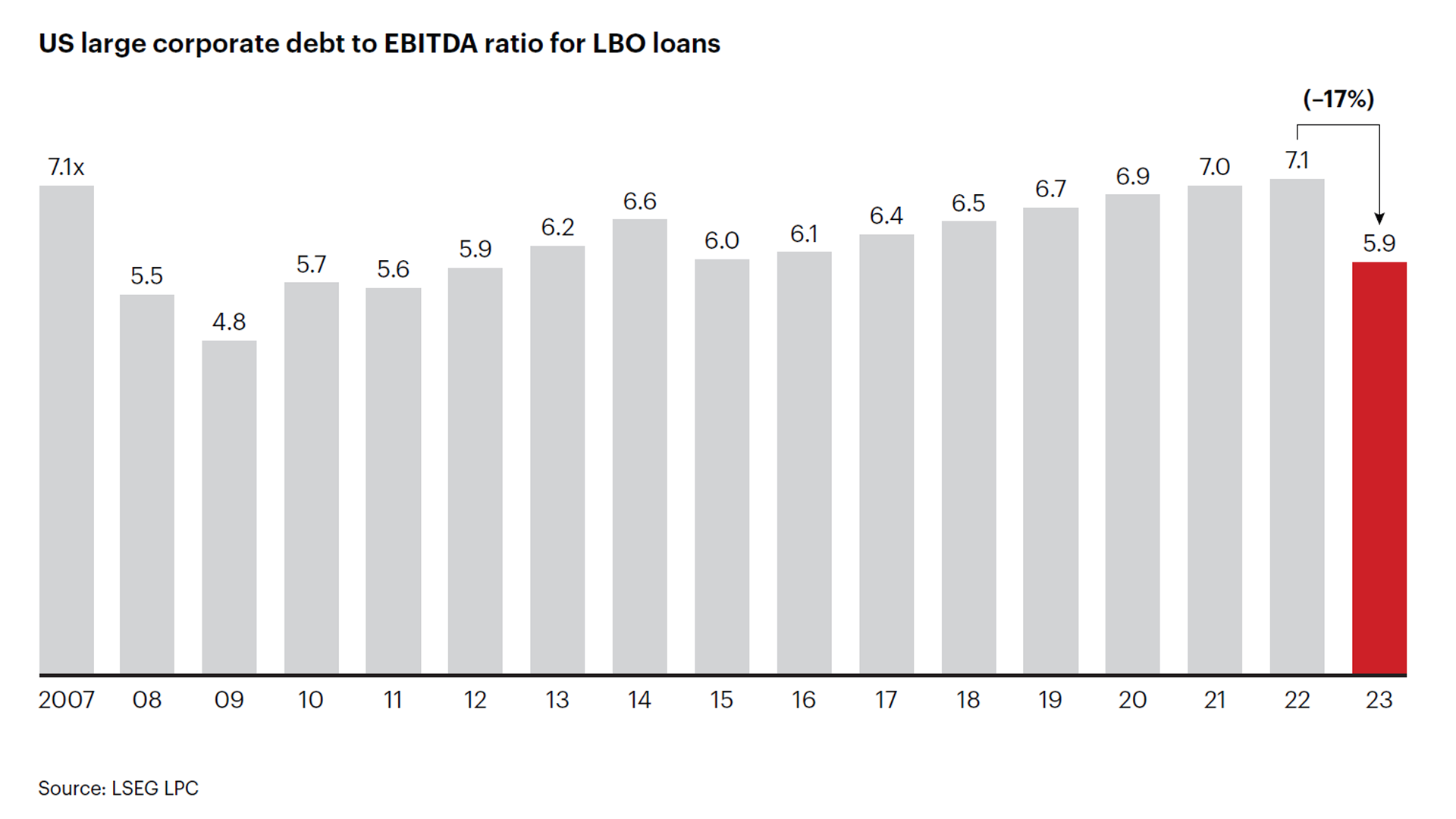

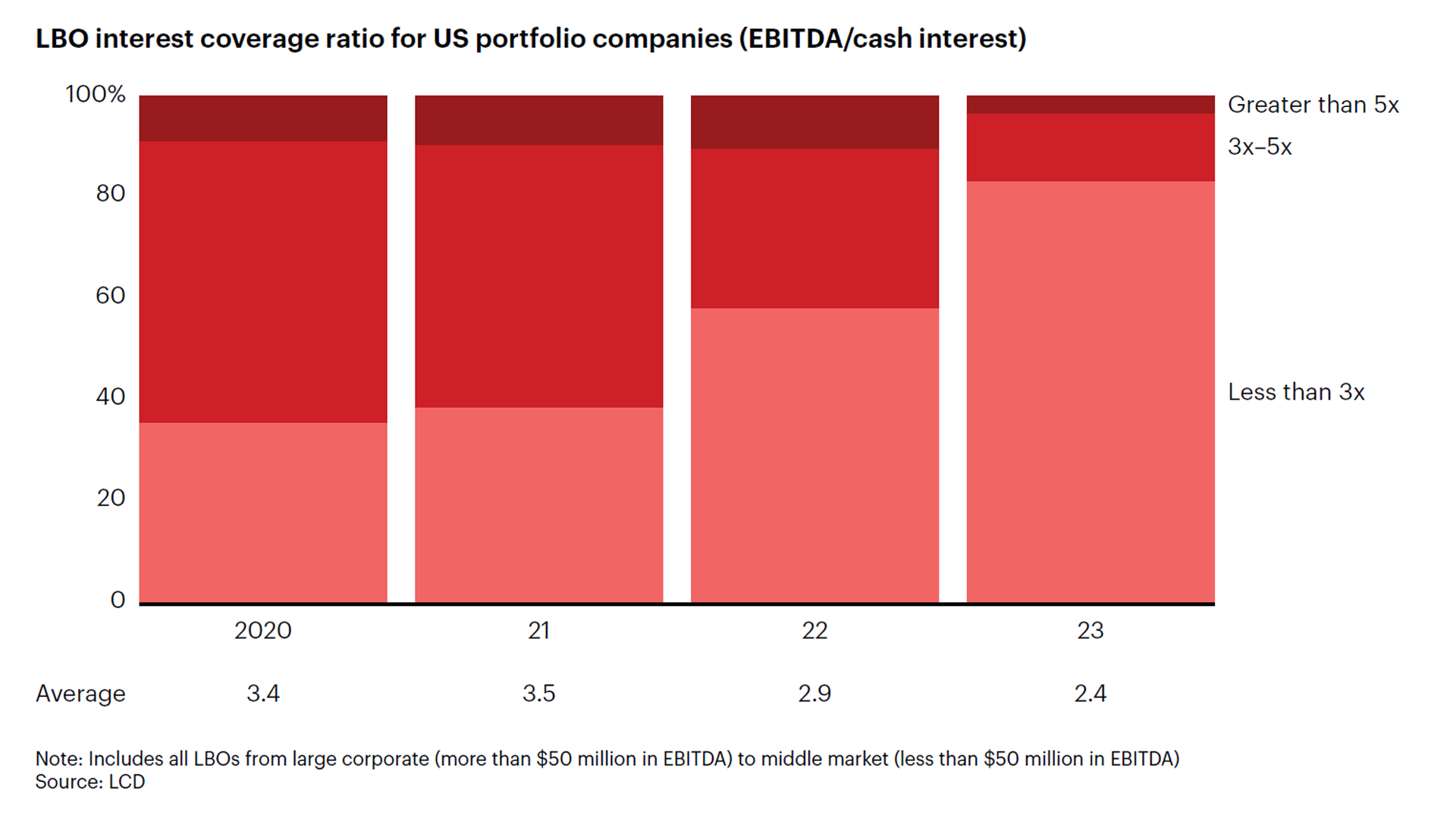

Debt Multiples and the Math Puzzle: Now, here’s where it gets interesting. Debt multiples in 2023 dropped a whopping 17% from 2022 to 5.9 times EBITDA.

Why? Because interest coverage ratios hit rock bottom. High interest rates not only make acquisitions pricier by raising the cost of capital but also add a mathematical twist to dealmaking. Reduced interest coverage ratios indicate financial vulnerability, which can have wide-ranging consequences for a company, affecting its relationships with creditors, investors, and its overall ability to navigate the complex landscape of the business world – more cash has to be channeled towards interest payments leaving less flexibility elsewhere!

Waiting for the Interest Rate Tides to Turn:

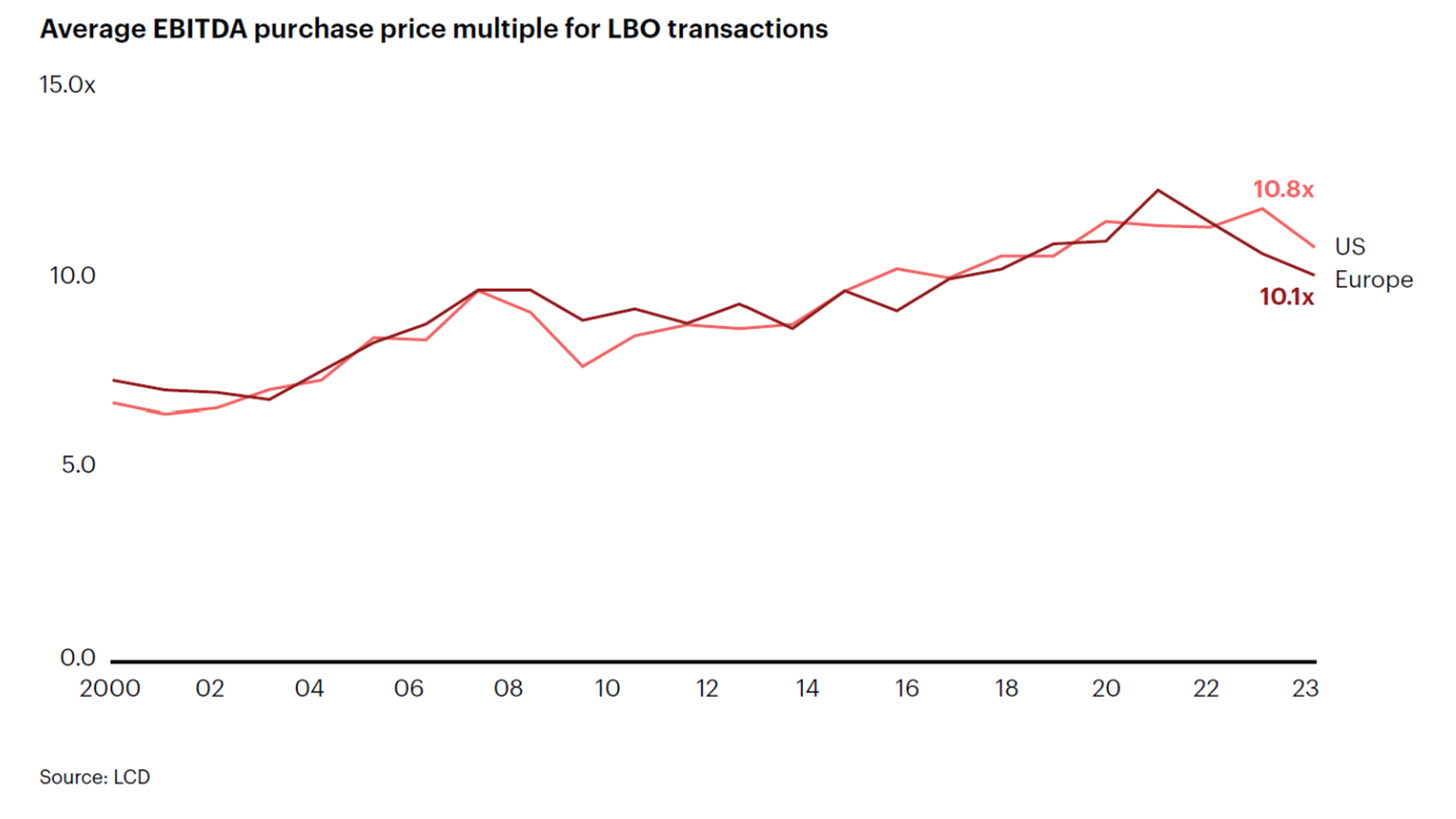

As interest rates promise to put the squeeze on price multiples, the private equity industry is facing a bit of a math challenge. Price multiples have dipped slightly over the past year but still hover around 11 times EBITDA in the US and 10 times in Europe. Sellers are holding out for strong assets, making the average target company historically expensive.

A Glimmer of Hope in 2024:

Here’s the silver lining – some moderation in interest rates might be on the horizon in 2024. As inflation steadies and central bankers work their magic for a soft landing, there’s hope for a more stable outlook. The industry is sitting on an astounding $3.9 trillion in unspent capital, with a hefty $1.2 trillion in buyout funds alone. The age of the dry powder is creating a massive incentive to get the ball rolling.

The Bottom Line: Buckle Up for 2024:

So, what’s the forecast for 2024? Investments may see a bit of improvement unless the macro environment decides to throw us a curveball. The potential for easing rates and the urgency to deploy capital could give investments a nudge, but brace yourselves – rates might not be going back to zero anytime soon. Pressure on multiples is here to stay, making the financial landscape a puzzle we’re all trying to solve.

In the next article we will talk about the observed returns in the private equity world and what the GPs may need to focus on for future value creation given there may be no respite coming from macroeconomic elements!

This is the first in the series of a few bite-sized articles that I shall be adding here using the report published by Bain & company on Global Private Equity report 2024

This article was written by Rasna Saini, Financial Training Instructor at Training The Street.

Learn more with Training The Street

Training The Street offers Corporate Learning Solutions, Public Courses and Self-Study Courses to help you and your team unlock your career potential.