Last week, Kraft Heinz bonds were downgraded to junk status, making it one of the largest “fallen angels” to enter the junk-bond market since 2005! Here are some key points…

- What is a “fallen angel”? A company that gets downgraded and loses its investment grade rating.

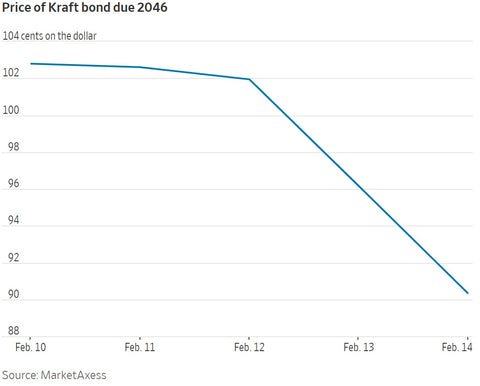

- What is the impact of the downgrade? Bonds tumbled from 102 cents on Wed, Feb 12 to about 90 cents on the dollar on Fri, Feb 14 from the downgrades.

- Why the downgrade? Despite recent attempts to refresh their brands, Kraft Heinz’ remains on the wrong side of the recent trend toward healthier eating. This pressures their sales and EBITDA, which in turn makes leverage ratios like Debt/EBITDA start to look worse. Financial ratios like leverage and coverage are critical to understanding the risk underlying a company, as discussed in our Financial Statement Analysis self-study on TTSacademy.com.

Learn more about the downgrade here.