https://www.cfo.com/human-capital-careers/2021/02/10-vital-roles-for-cfos/

February 24, 2021

10 Vital Roles for CFOs

To ascend to (and remain in) the office of CFO and be great at the job, you will have to master these responsibilities.

If CFOs have learned anything in the past year, it’s that they must be agile and innovative leaders skilled at predicting and planning for a future that is anything but predictable. The essential skills for CFO success go far beyond mastery of the financial basics, the ability to adopt popular management practices, or even the intuitiveness to know what the CEO is thinking. Those are just table stakes.

The differentiators that make for an effective CFO take place in a far wider arena: for example, the ability to provide strategic business advice, communicate effectively in new ways and to more audiences, and deploy the latest technologies for maximum efficiency and minimal risk.

But what competencies and skills do CFOs, board members, and others list as the requirements for corporate and career success as a finance chief? We found that the answers clustered in 10 major areas.

1. Strategist

Think a finance chief can just slipstream behind a larger-than-life CEO? Think again. “Boards want a CFO who is the right-hand of the CEO,” says Sheila Hooda, a board director of multiple public and private companies. “A CFO at the highest level moves from someone who is an accounting and finance expert with technical skills to someone who is a multidisciplinary strategist,” she says.

Toya Lawson, a partner at executive recruiter Bridge Partners LLC, agrees, saying that her clients want more than a CFO who can deliver data. “The CFO needs to think not just about the numbers that help the CEO make decisions, but also about bringing the right people to the table to help make those decisions,” she says.

This ability to be a trusted strategic adviser is crucial during the COVID-19 pandemic, according to one industry veteran.“The current crisis is fundamentally a financial one and, as companies change their business models, the CFO has to be front and center in that decision-making process,” says Jack McCullough, president of the CFO Leadership Council.

“You need a CFO who is a strategic adviser focusing on value and growth rather than just crisis management and mismanagement,” adds Anthony Coletta, CFO of enterprise application software company SAP North America.

2. Cross-Functional Expert

Mere familiarity with operations isn’t good enough.

Steven Springsteel, CFO of Betterworks, a human resources technology company, started developing broader expertise when he worked on various finance projects in several divisions of a major corporation as part of a management training program. “That set the tone for me going forward — my career has always been focused on driving the business and looking at the operational side of things. It taught me that the finance function sits at the center where all information comes together,” he recalls.

Now executive vice president and CFO of specialty pharmaceutical company BioDelivery Sciences International, Terry Coelho was general manager and president of Mars Brazil earlier in her career. Her responsibilities included building the company’s first Brazilian candy factory and launching a brand. Through the years, that position and others allowed her to bring a deep understanding of disciplines outside the finance silo — from supply chain to marketing — to her current role.

While general manager experience isn’t realistic for many CFOs, there are other ways to learn more about and understand other areas of the business, Coelho says: “Go out with a sales rep to see what challenges they’re facing and hear what customers are saying. If you manufacture goods, walk the production line and learn more about the logistics challenges.”

3. Data Storyteller

Interpreting data goes beyond throwing up graphics on a Powerpoint slide.

Stakeholders want CFOs to not only report the numbers but also share the story behind them. This is particularly important, says board adviser and former Procter & Gamble CFO Lars Sudmann, because digital dashboards now make a company’s financials more widely available internally.

“The key skill will be to make sense of that data. For that, the CFO needs to be able to walk people through the meaning behind data so that they understand the implications and next steps on the journey,” he says.

McCullough suggests CFO storytelling won’t necessarily mimic the marketing department’s narrative: “It’s a different kind of storytelling because, with CFOs, there can be no spin, no exaggeration. People are making decisions on this.”

Coelho says good storytellers are innately curious. “It’s not stopping at the obvious. They ask, “Why? And then what?” she says.

4. Crystal Ball Reader

Boards and CEOs want analysis to not only be accurate but also fast.

“It’s a bit unfair but CFOs and their teams are tasked with forecasting more quickly and with fewer mistakes than before. The days when forecasting could take several weeks are gone,” says McCullough.

According to Robert Rostan, CFO of Training the Street, an organization that educates junior finance professionals, the aftermath of the 2020 election poses all sorts of forecasting challenges. “Taxation will probably change but will interest rates? How do we drop those unknowns into a model and perfectly forecast what’s going to happen? You have to move on because business requires decisions — and often quick decisions,” he says.

Chermaine Hu’s crystal ball looks like a newspaper. The CFO of fintech company Episode Six uses the media to monitor global news and developments both inside and outside her industry. “All of these moving parts might not feel directly relevant but staying in touch with what’s going on in the world helps me think through how it applies to the business,” Hu says.

5. Driver of Digital

Digital fluency is more important as finance departments increasingly use technology to streamline and automate processes.

“More and more forward-looking organizations are looking to the finance department to be less focused on reporting historical numbers and trends and more focused on collecting and analyzing data and predicting trends,” says Steve Gallucci, who leads consulting firm Deloitte’s U.S. CFO Program. “CFOs must have the wherewithal and knowledge to put systems in place to get real-time information analyzed and distributed to stakeholders.”

This isn’t something that can wait, says Coletta at SAP. “You can’t delay investing in technology or question why it does or doesn’t matter. You need real-time data,” to guide decisions, he says.

Board member Hooda expects a CFO to be extremely knowledgeable about technology and how to use it to both advance the business and protect it against cybersecurity and data privacy risks. Says Hooda: “If the CFO isn’t going to have a handle on this, he or she is going to be a bird that’s trying to fly with one wing.”

6. Technology Researcher

Former CFO Sudmann recommends CFOs become more digitally fluent by forming a team that researches finance technology. “It’s important to truly commit time and resources toward constantly exploring and testing new things,” he says.

In addition to assigning this “R&D” responsibility to specific individuals, CFOs could schedule a monthly finance leadership team meeting for exploring and testing new tools and applications. “From what I’ve seen, what makes the difference with a lot of CFOs is diving in and trying things out themselves,” Sudmann says.

Understanding the latest technology options was particularly important to Coelho when she joined BioDelivery Sciences in the startup stage and had to build an infrastructure she could scale. “Talk to colleagues at other companies about what they’re implementing,” she says. “It’s important to invest the time, not to become a systems guru, but to understand the solutions that are possible.”

At Episode Six, Hu addresses this need in part by filling non-developer positions with younger, less experienced digital natives who are solidly connected to current technology and trends. “Bringing young people into the organization is an easy way to access the latest and greatest about new technology and learn what people care about in general,” she says.

7. Agile Performer

It didn’t take long for “pivot” to become the buzzword of the pandemic. As any personal trainer knows, though, you can’t pivot quickly and easily if you aren’t agile.

Nobody knows what’s coming next, points out Coelho. Because of that, she says, CFOs need “a mindset that’s open to doing things differently. It’s about bringing multiple options to the table that are strategically sound but also feasible.”

“CFOs need to be able to cope with the rapid pace of change. They have to become leaders and mobilize teams as change accelerates,” agrees SAP’s Coletta.

To update plans and strategies quickly, consultant and former P&G CFO Sudmann advocates using his rapid strategy creation method, which relies on an already-created strategy framework or template, speedy planning, and tapping into the organization’s internal wisdom. “Two-month planning-cycle thinking needs to be adjusted and replaced,” he says.

The need for agility in a fluid business environment resonates with Training the Street’s Rostan, who pivoted to become far more knowledgeable about commercial real estate because of the pandemic. “Considering the uncertainty, we’re looking at our leases and thinking about ways to optimize them going forward,” he says.

Of course, agility may mean making decisions with less-than-perfect information. “Get comfortable with the unknown; with moving forward by conferring with your experts, trusting your gut, and learning from your mistakes,” Rostan advises.

8. Team Builder and Leader

While finance team hiring is typically managed by human resources, many CFOs play an active role because they believe it’s important to get the right fit for the corporate culture generally and the finance team specifically.

That process can be time-consuming, Coelho notes, but she believes it’s time well-spent. The cultural fit is as important as technical skills, she believes. “It’s taking the time, being patient, and not feeling like you have to hire the next candidate to fill a slot. I spend a lot of time working to understand the person, what motivates them, and how they work best,” she says.

Hu’s company uses LinkedIn to fill junior to mid-level positions and personal networks for more senior roles. She focuses not only on acquiring top talent but keeping it. “It’s also about giving them what they’re looking for in their career,” she says. That often means using technology to free employees up from “the boring tasks” and offering more opportunities to learn and acquire new skills.

9. Empathetic Manager

Though some CFOs have impressive technical backgrounds, that generally is not their key to success. The soft skills are what make a great executive, according to Gallucci of Deloitte. “It’s about empathy, compassion, openness.”

Springsteel of Betterworks singles out empathy. “Employees who work from home with children have it the hardest of anybody” and deserve empathy during the pandemic, he says. At the same time, he believes that empathy must extend beyond employees to customers, as well.

“If a customer is having a tough time and says they need more time to pay the bill, show them some empathy,” he adds. Discuss how you can work together to solve the problem.

Springsteel knows firsthand how this not only helps both parties during difficult periods but also solidifies relationships. “When COVID-19 hit, we went to every vendor to renegotiate our agreements. They didn’t have to do it but they said they were there to help,” he says.

10. Communicator

Being a great communicator has never been more important because CFOs are talking to more stakeholder groups than ever, says Hooda. In the past, she says, CFOs might have been focused on communicating with investors and shareholders. Today, they’re sharing company messages and information with employees, customers, suppliers, and the community.

“Both the outside and inside world look to the CFO as the voice of truth,” says Springsteel. “Recognize that you’re that voice. Be the one to speak up.”

McCullough of the CFO Leadership Council points out that CFOs are typically the most trusted executive both internally and externally because they are obligated to focus on the facts without spin. Because CFOs have to be in constant communication with all of an organization’s constituents, he believes that “those with exemplary communications skills are an extraordinary asset to any company.”

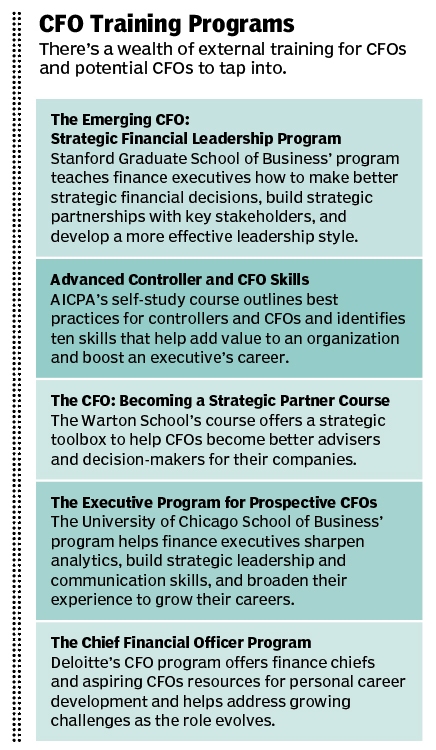

Checking the Boxes

Do you come to the position with all of these skills? Perhaps not, but many can still be acquired, says Gallucci, by making professional development a priority. “Seek out stretch assignments, participate on a steering committee, get involved in a technology-enabled transformation,” he recommends.

And what is someone who recruits CFOs looking for? “Strategic thinking skills separate the old CFO from the new,” Lawson of Bridge Partners says. “It’s one thing to see the numbers. It’s another to use them to get you where you want to go.”

Sandra Beckwith is a freelance business writer.