Charlie Munger, Buffett’s long-time partner, and chairman of Daily Journal Corporation (DJCO) was answering shareholder questions today when the subject of crypto came up.

On being asked whether he was wrong about buying crypto, Charlie said, “I’m proud that I never invested in Crypto. It’s like venereal disease”.

That’s nice Charlie. That’s real nice.

But where does that leave us Charlie? Us folks who actually have to calculate the enterprise value of companies like Tesla and Microstrategy – companies that have large amounts of venereal disease Crypto on their balance sheets.

Enterprise Value

Enterprise Value (EV) is an extremely important metric in valuation, more important than the market value of equity aka the market cap. And that’s because EV accounts for all forms of capital used in order to finance the company – equity, debt, and everything in between such as convertibles, preferred stock, mezzanine debt, etc.

Companies finance themselves in all sorts of ways – some with just equity, some with a little bit of debt, some with lots of debt, and some with all kinds of financial instruments. Comparing companies with different capital structures involves comparing EVs. Here’s Van Vu explaining the concept in more detail.

Calculating enterprise value can be tricky. People often take the easy way out – they look at a 3rd party database and take the numbers at face value. This works if you have a passing interest in the company but it if you are going to do serious valuation work this could be problematic.

For example, let’s look at Shopify, an e-commerce platform that helps businesses run online store.

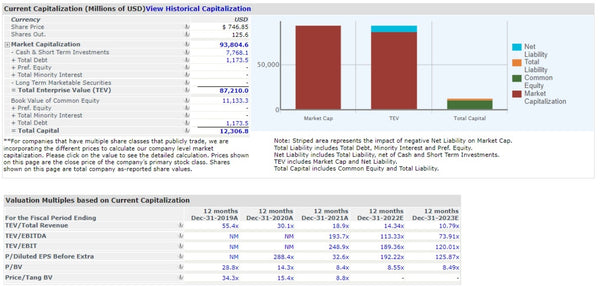

According to CapIQ Shopify’s EV is $87,210M.

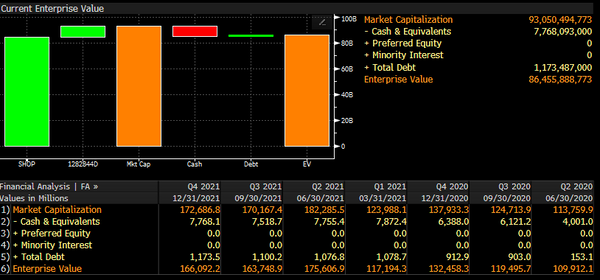

Bloomberg says it’s $86,456M.

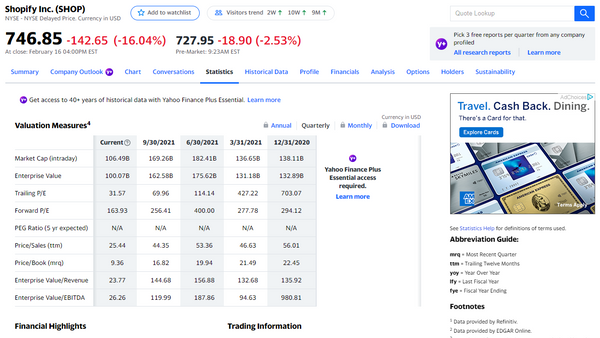

And, Yahoo! Finance has it pegged at $100,078M.

To most casual observers these differences look too small to matter. But if you’re a banker working with Shopify as a client, or valuing a company using Shopify as a comp, writing a fairness opinion, writing a sell-side research report, recommending buying a block of Shopify shares to your investment committee – basically any one of the number of situations you might find yourself in as a finance practitioner, the precision matters.

But what’s the source of these differences?

Could be any number of things – multiple classes of shares (Shopify has two), stock based comp, adjustments for leases, or it could just be an incorrect adjustment for cash equivalents, which brings us back to Microstrategy and its Bitcoin horde.

In our valuation courses at Training The Street we cover all these complexities and much more

Remember in that video Van Vu was telling us that the shorthand definition of EV is simply Market Cap plus Net Debt? That second part, the net debt, is debt net of cash and cash equivalents. When calculating EV, we assume that anything that’s cash or cash-like can be used to pay down the debt, hence we simply subtract it from the gross debt.

But what exactly is cash-like?

Is cash sitting in the bank cash-like? Obviously.

Are investments in US treasuries, the most liquidly traded financial instrument in the world, cash-like? Yep.

What about an investment in an ETF? Stock of another company? A corporate bond? A bank CD? Mmm…maybe?

Cash equivalent is a judgement call.

At TTS we suggest a two step-test to determine the cash-y-ness of an asset:

- Is it liquid, i.e., can it be readily sold and turned into cash?

- Is it non-core, i.e. would selling it make little difference to the company’s core operations?

Two yesses and it’s almost certainly cash. A no on the first and a yes on a second means more work.

MSTR currently has 124,291 Bitcoins on its balance sheet. At current prices that position is worth about $5bn. Its market cap is $4.7bn and it has $2.2bn in debt. If you don’t adjust for Bitcoin then you’ll calculate the EV to be $6.9bn – CapIQ, Bloomberg, and Yahoo! Finance would all agree with you. If you do adjust for Bitcoin, the EV goes all the way down to $1.9bn, which is only 30% of the widely reported figure. Regardless whether you agree with Charlie or not you’re going to have to think hard here.

So what is $5bn in Bitcoin? Liquid or illiquid? Core or non-core? We’ll let you decide. Tell us what you think. And, in case you’re looking for management guidance in the matter, here’s Michael Sayler, the CEO of Microstrategy:

Helpful. Right?

Assessing enterprise value continues to evolve in today’s financial world. Training The Street offers both instructor-led live courses and self-study options to sharpen your financial skills. Our courses stress the consistency, clarity, and efficiency required when analyzing complex situations and finance concepts. Our goal is to put the fundamentals of finance at your fingertips.

Browse our instructor-led courses here

Self-study courses here

For additional information or questions send us an email at info@trainingthestreet.com.