By Rasna Saini

The Global Private Equity industry ended 2022 with a record $3.7 trillion in dry powder! However, the impact of the unprecedented mix of macro forces in play puts a question mark on how and when the GPs will put it to work.

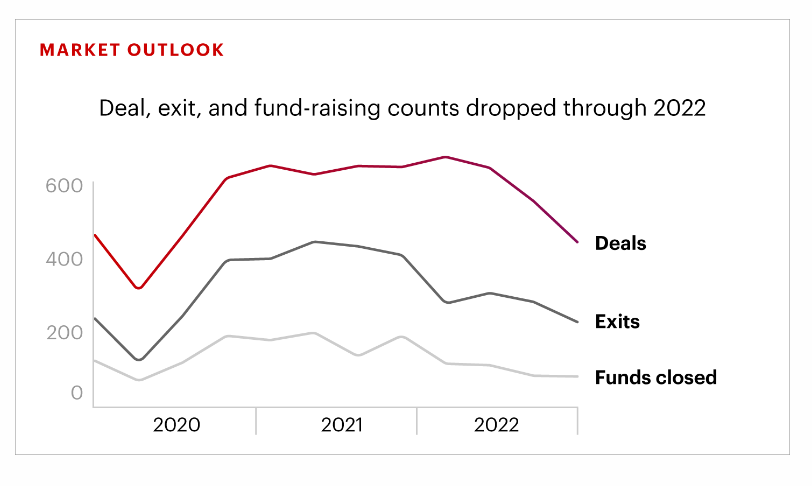

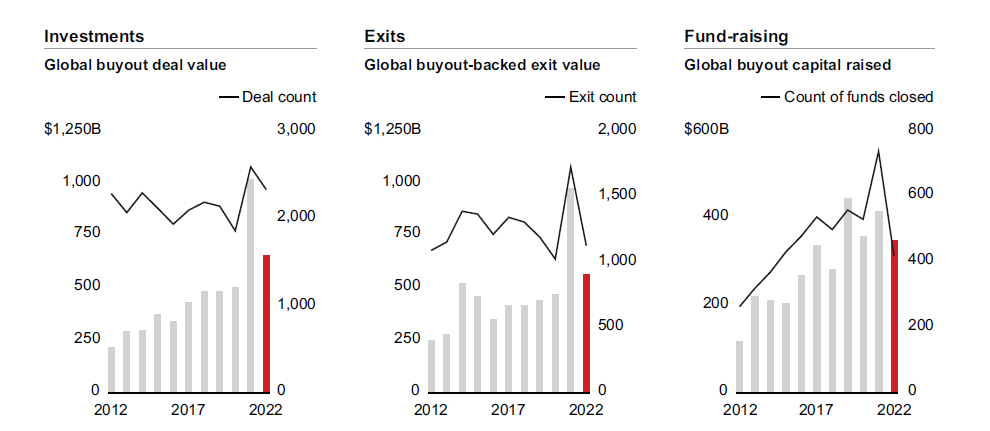

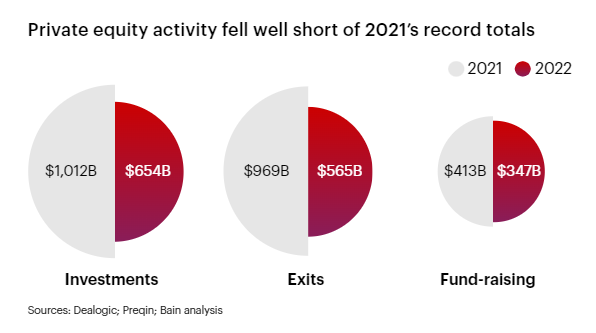

Investments, exits, and fund-raising all declined in 2022 as macro forces took their toll:

Why? Let’s look at that:

Why? Let’s look at that:

What makes the current economic slowdown different from the one brought on by the global financial crisis is the lack of clarity about what’s happening. There’s no Lehman collapse, no housing meltdown, no sharp falloff in economic activity to signal a definitive sea change. Instead, the global economy is presenting investors with conditions few among them have ever seen before.

As extraordinary and resilient as the post-Covid rally in global private equity proved to be, it was ultimately no match for the Fed. Rise in interest rates has reversed a downward trend that has defined investment markets for as long as anyone can remember. Banks pulled back from funding leveraged transactions and dealmaking fell off a cliff, pulling exit and fund-raising totals down with it.

Where we stand today is in the world of “uncertainty” which will continue to act as a cap on deal activity, especially for the largest transactions that require the most leverage while smaller transactions can still be funded with private credit and larger equity infusions.

Where we stand today is in the world of “uncertainty” which will continue to act as a cap on deal activity, especially for the largest transactions that require the most leverage while smaller transactions can still be funded with private credit and larger equity infusions.

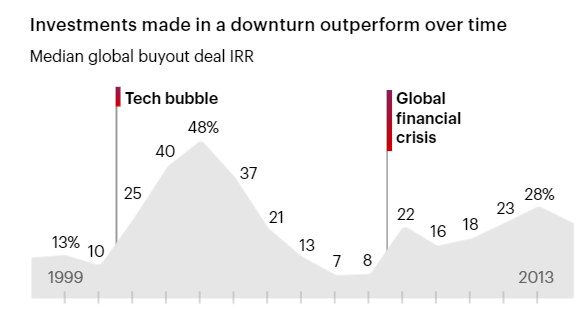

So what do we do? The lessons from the last downturn are particularly useful in plotting a course through this time of uncertainty and turbulence. Put succinctly, the winners didn’t panic last time around. They properly assessed their risk scenarios, created mitigation plans, and set themselves up to accelerate out of the downturn.

Mitigating risk: Confidence boils down to learning how to underwrite risk in a time of great macro uncertainty. This confidence flows from a different set of muscles than most GPs are used to exercising.

Uncertainty and downturns have happened previously too, and the winners last time around used this kind of insight to get back in the game as quickly as possible. The data is clear:

- Deals done through a downturn generate superior returns over time. (see image below)

- Leaders keep finding deals that they like and can underwrite confidently by making sure the macro factors are accounted for.

- They also stay aggressive and aren’t deterred by lingering adverse capital conditions.

- If a deal targets a good asset at a good price, it may be worth getting it done with more equity or a higher price on the debt than you’d like.

- You can always fix the balance sheet when conditions improve, but waiting risks losing a valuable opportunity to profit from the rebound.

While it makes practical sense to conserve cash, draw down lines of credit, and otherwise build a war chest for surviving a recession, it’s also important to look for opportunities to stay on offense. Accelerating out of a recession starts with taking a fresh look at a portfolio company’s competitive position and plotting how to use the downturn to take market share from competitors. This always depends on subsector dynamics and the strength of the competition. But the companies that are prudently aggressive—vs. conservative and reactive—are the ones that shift profit pools during recessions.

Discerning opportunity, while mustering the wherewithal and courage to go after it, ends up generating superior performance over time.

Discerning opportunity, while mustering the wherewithal and courage to go after it, ends up generating superior performance over time.

If you are interested in learning more about the Private Equity industry, check out our Private Equity Public Course, Private Equity onsite training solutions, or contact us at info@trainingthestreet.com.

This is the first in the series of a few bite-sized articles that Rasna Saini will be writing here using the report published by Bain & company.