In this article, we will discuss the Buy and Build in Private Equity strategy and how it faired in the last decade.

By Rasna Saini

In private equity (PE), the “buy and build” strategy refers to an approach where a PE firm acquires a platform company and subsequently expands its operations through a series of add-on acquisitions. The primary goal is to accelerate growth and enhance the value of the platform company by creating a larger, more diversified company with enhanced market presence.

So what really happens? Here’s an overview of the buy and build strategy in PE:

- Acquisition of a platform company: The PE firm identifies and acquires a platform company that serves as the foundation for growth. The platform company is typically a well-established business with strong fundamentals, a solid market position, operational capabilities, and growth potential.

- Organic growth and operational improvements: Initially, the PE firm focuses on improving the platform company’s operations, efficiency, and profitability through organic growth initiatives. This may involve enhancing sales and marketing strategies, optimizing operations, improving financial performance, or expanding into new markets.

- Identifying add-on acquisitions: Once the platform company is optimized, the PE firm seeks to identify and acquire smaller companies (strategic add-on acquisitions) that complement the platform company’s operations, products, or market reach. Multiple arbitrage plays where a GP buys smaller companies at lower multiples to build them into a larger one that will command a higher valuation. These add-on acquisitions are typically smaller in size and may operate in the same industry or adjacent sectors.

- Synergies and integration: The PE firm aims to realize synergies by integrating the platform company with the add-on acquisitions. This could involve consolidating operations, streamlining processes, leveraging shared resources, and capturing cost efficiencies. The objective is to create a stronger and more competitive combined entity.

- Market consolidation and growth: Through the series of add-on acquisitions, the buy and build strategy aims to consolidate the market by expanding the platform company’s product offerings, customer base, geographical reach, or capabilities. The strategy leverages the combined strengths of the platform company and the acquired businesses to achieve accelerated growth and capture a larger market share.

- Value creation and exit: The ultimate goal of the buy and build strategy is to create substantial value for the PE firm and its investors. By executing successful add-on acquisitions, achieving operational improvements, and driving revenue growth, the PE firm aims to enhance the overall value of the combined entity. This increased value can be realized through an eventual exit strategy, such as selling the consolidated company to a strategic buyer, conducting an initial public offering (IPO), or other liquidity events.

The buy and build strategy allows PE firms to actively participate in the growth and transformation of the platform company, leveraging strategic acquisitions to create a larger, more competitive, and valuable entity. It requires expertise in identifying suitable targets, effective integration capabilities, and careful execution to achieve successful outcomes.

How did buy and build fare in the last decade?

In the last decade, the buy and build strategy in private equity (PE) has continued to be a popular approach for value creation and growth. Favorable economic conditions, low interest rates, and ample available capital have created conducive environments for buy and build strategies. These conditions have facilitated financing for acquisitions and provided opportunities for private equity firms to deploy capital in pursuit of growth-oriented investments.

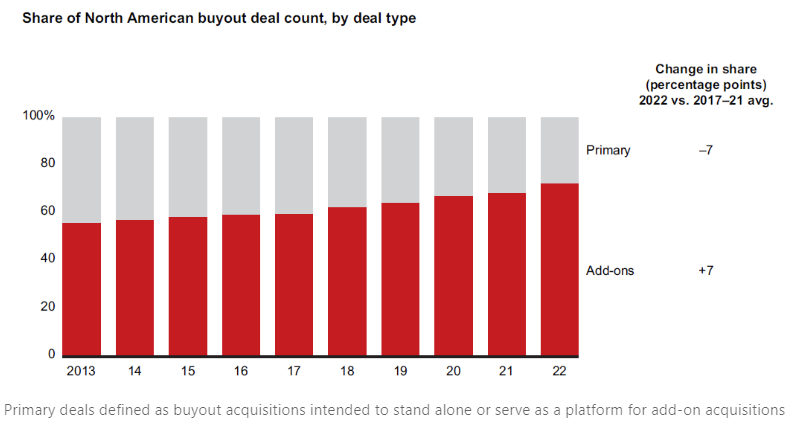

However, Federal Reserve’s rate hike in June 2022 signified the end of cheap debt in buyout markets and raised strong concerns about persistent inflation. Followed by the banking industry’s reluctance to lend to large leveraged transactions which dictated how the year in dealmaking ultimately unfolded. With the banks essentially closed for business, smaller transactions requiring less debt picked up share in the overall totals.

The appeal and feasibility of smaller deals can be seen in the growth of add-ons, deals that are financed from the balance sheet of a portfolio company, usually to expand its footprint or add an adjacency. Add-ons made up 72% of all North American buyouts in 2022 by deal count.

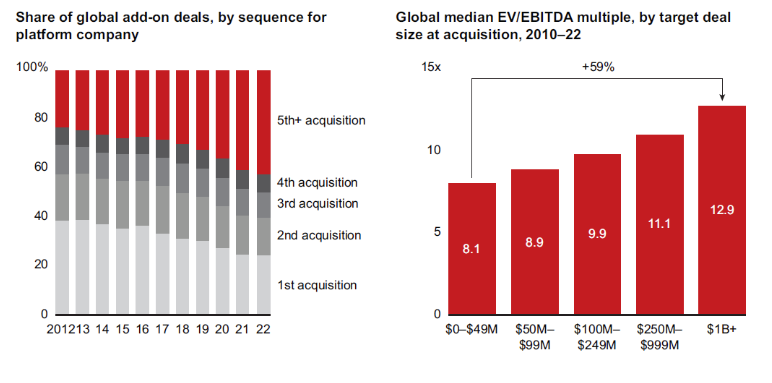

The buy and build strategy has been observed across various sectors including technology, healthcare, consumer goods, industrials, and more. PE firms have targeted sectors with growth potential, fragmented markets, and opportunities for consolidation to execute successful buy and build strategies. A growing share of the smaller deals were used to further buy-and-build strategies—like mentioned before, multiple arbitrage plays where a GP buys smaller companies at lower multiples to build them into a larger one that will command a higher valuation.

The buy and build strategy has been observed across various sectors including technology, healthcare, consumer goods, industrials, and more. PE firms have targeted sectors with growth potential, fragmented markets, and opportunities for consolidation to execute successful buy and build strategies. A growing share of the smaller deals were used to further buy-and-build strategies—like mentioned before, multiple arbitrage plays where a GP buys smaller companies at lower multiples to build them into a larger one that will command a higher valuation.

While GPs have gravitated to add-on and buy-and-build strategies in ever greater numbers, we’ll see whether these moves will pan out for all of them. Add-ons increasingly serve buy-and-build strategies as dealmakers create large, high-multiple platforms from small, lower-multiple acquisitions.

While GPs have gravitated to add-on and buy-and-build strategies in ever greater numbers, we’ll see whether these moves will pan out for all of them. Add-ons increasingly serve buy-and-build strategies as dealmakers create large, high-multiple platforms from small, lower-multiple acquisitions.

Overall, the buy and build strategy has evolved and adapted over the last decade to reflect changing market dynamics and investor priorities. The strategy remains a prominent avenue for private equity firms to drive growth, create value, and capture opportunities in fragmented markets.

There are many interesting examples of the buy and build strategy from the industry. I will leave you with a prompt to do this search on ChatGPT but make sure you assess the information and verify it using reliable sources, after all it is still evolving and has a data availability cutoff of September 2021.

If you are interested in learning more about the Private Equity industry, check out our Private Equity Public Course, Private Equity onsite training solutions, or contact us at info@trainingthestreet.com.

This is the second in the series of a few bite-sized articles that Rasna Saini will be writing here using the report published by Bain & company.

Read Rasna Saini‘s first story here